A client was concerned about financial health of some of the properties in their portfolio. While confident the properties had enough cash flow to weather some financial headwinds there was concern that an unknown climate or natural disaster could upset the financial picture.

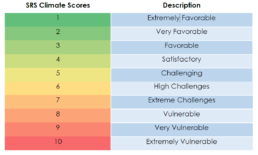

The SRS Climate Scores measure the exposure to location-specific climate factors that have negative impact on an asset’s value and long-term viability. The SRS Climate Scores 1 are calculated at the census tract, postal code, city, school districts, county, congressional districts, state geospatial layers, or on a user-defined geographic area.

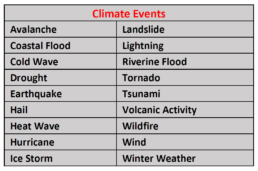

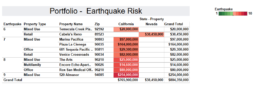

As part of the climate risk due diligence SRS examined the properties for the 18 climate events that it currently monitors. An alphanumeric score was assigned to the property if the location falls in the 6-High Challenges to 10-Extremely Vulnerable range. Everything below a 6 for this analysis was ignored.

Climate risk must first be known before they can be planned for, and mitigated

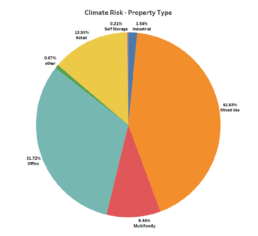

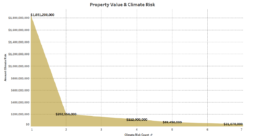

The portfolio of 42 commercial properties is diversified across the US with a value of $6B. SRS analysis found that $2.4B or 40% was in a climate hazardous location with at least one climate condition that was of concern and 9% carried multiple potentially disastrous climate conditions.

1The Climate Risk Scores are divided into 10 risk bands where 1 is the least risky and 10 is the most severe and are meant to

communicate long-term risk.

The pie chart shows the property types in the portfolio most affected by climate risk. Mixed Use held the top spot with 42% followed by Office at 31%.

We then looked at the individual climate conditions that could negatively affect the portfolio’s value. Since it is a portfolio of commercial properties, we decided to match the property’s risk at the postal code geospatial level.

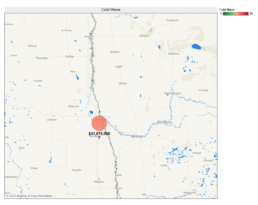

- Cold Wave – Two multifamily properties in North Dakota with a combined value of $31M have a cold Wave Risk of 7– Extreme Challenges.

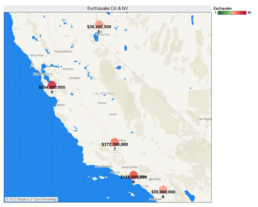

2. Earthquake – The earthquake risk in the portfolio is concentrated in California with an additional property in Nevada for a combined value of $804M. The earthquake risk ranges from 6-High Challenges to 9 Very Vulnerable.

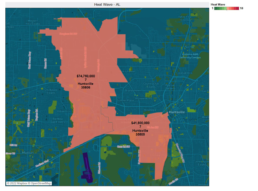

3. Heat Wave – Significant risk is concentrated in Alabama with $116M of the total $193M of the heat wave risk that exists in the portfolio.

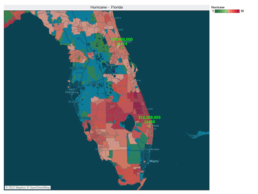

4. Hurricane – The portfolio carries $217M in hurricane risk with 2 properties in Florida bearing the brunt with $85M of exposure.

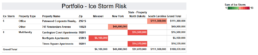

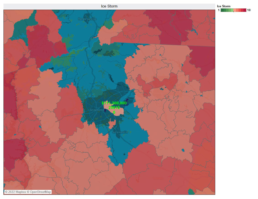

5. Ice Storm – The ice storm risk in the portfolio is spread through four states but the bulk comes from 1 property in South Carolina that holds $111M of the $188M at risk.

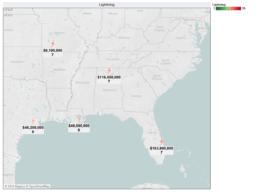

6. Lightning – The portfolio’s lightning risk is 6-High Challenges and 7-Extreme Challenges with an all-in risk total of $378M.

7. Riverine Flood – Two properties in Texas float a flood risk of 9-Very Vulnerable with $46M at stake. A Washington Street property in New York at $217M has the most risk financially with a flood risk score of 6-High Challenges.

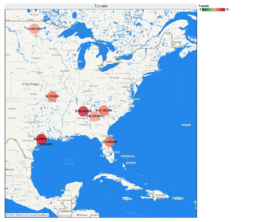

8. Tornado Risk – The portfolio has considerable tornado risk impacting $426M of the properties within the portfolio. The properties in Alabama sit at a location with a tornado score of 9-Extremly Vulnerable is a cause of concern with $116M at risk.

9. Wind – The wind risk is significant at $811M, which makes it the single most financially damaging climate risk embedded in the portfolio. However, this number is skewed by one retail space in White Plains, NY with $647M at risk.

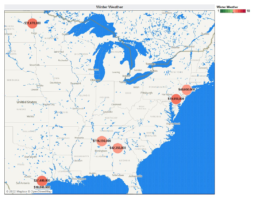

10. Winter Weather – The Alabama properties in the portfolio lead the winter weather risk with $116M at risk followed by Texas with $46M.

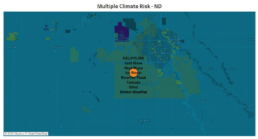

The SRS Climate due diligence also examines each property location for overlapping climate hazards and found properties with multiple climate vulnerabilities.

The North Dakota assets carry seven potentially hazardous climate conditions and must be actively monitored.

Other properties’ in the portffolio with a greater financial impact also have multiple climate risk factors that must be understood and planned for.

SRS further considers each climate risk factor to ensure they do not add fuel to other climate conditions present at the location. For example drought, heat, wind are know to aggravate wildfire risk. If these conditions were present in the same location a risk multiplier would be considered for the location which could increase the overall risk level of the SRS Scores.