Portfolio Managers

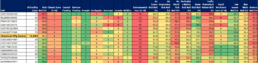

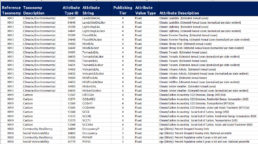

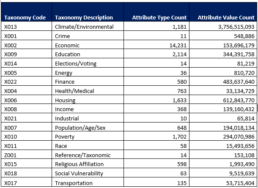

Can portfolio managers ignore the spatial-level risks associated with their portfolio companies? Understanding how facility-level factors can drive short-term and long-term portfolio valuation is becoming a core function for investment selection and portfolio management workflow, with over 270 spatial-level factors evaluating natural disasters, environmental exposures, carbon emissions, and local socio-economic conditions. SRS provides a comprehensive picture of spatial risks previously unattainable with existing ESG-based reporting solutions.