The SRS Knowledge Graph reveals CARES Act award recipients outperformed the S&P 500 benchmark by 60%

The SRS Knowledge Graph reveals CARES Act award recipients outperformed the S&P 500 benchmark by 60%

New York, February 9th, 2021

– Understanding stock performance of COVID-19 award recipients – SRS’s data science team is excited to share an interesting correlation between government spending surrounding COVID-19 CARES Act and stock performance of public companies participating in the program.

CARES Act and other COVID-19 supplemental appropriations resulted in a very large volume of contracts awarded by the Health and Human Services Administration (HHS) to a variety of commercial entities, both public and private.

Companies participating in COVID-19 related development include manufacturing, distribution and delivery of personal protection equipment, vaccines, test kits and related materials and services.

Using the spending data available from the US Government we identified the top 22 public companies who received COVID-19 related HHS awards, analyzed their corporate linkages to identify the ultimate parent. We then excluded the 2 best and 2 worst stock performers from the analysis.

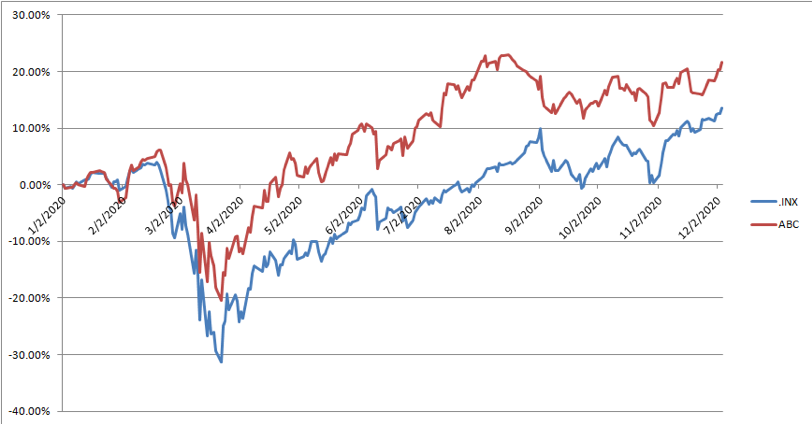

The resulting set of companies offered a sensible representation of supply chain representation. It included companies operating in pharmaceutical, base chemical components, manufacturing, distribution, medical equipment, and service delivery sectors. Company stock returns were analyzed for the time period between January 2 and December 4 2020 and compared with return of S&P Index (.INDX). The resulting set of 18 COVID-19 award recipients performed markedly better than the rest of the market. While S&P 500 index delivered 13.5% return during this period the average return of the COVID-19 award recipients exceeded 21%.

Alex Vengerovsky, SRS Chief Data Scientist says :

“By connecting and correlating multiple data sets some interesting questions arise. If we assume that vaccinations, testing and other health management measures to fight the pandemic are here to stay then the government funding would represent a new and continuous revenue stream for the whole supply chain. Should that data be accounted for in assessing performance of the portfolios?”

For more information, please visit SRS’s web site or email support@spatialrisksystems.com

About Spatial Risk Systems:

Spatial Risk Systems is a data connectivity company focused on open data set integration and spatial finance. Highly precise and connected data (i.e., Knowledge Graphs) are emerging as important factors in expanding and improving data sciences outcomes including revealing hidden data relationships, ML/AI, and Data Visualization.

Alex Vengerovsky previously spent the past 15 years focused on all things data at the Westport, CT based hedge fund, Bridgewater Associates